Options for BIM/VDC in your MEP Shop

Updated: 2023.02.20 – (Updates in RED)

I have a lot of people contact me and ask about software tools. They usually only know of some of them but not all of their options. Often they don’t fully understand what all they do or don’t do and how they may compare to each other.

So I figured I’d throw together a little summary of the better options that I’m aware of. There’s others out there but they’re really not penetrating the market or working toward integrating with other solutions near as I can tell. OR perhaps I’m just clueless and haven’t run across them yet.

I’ve listed the tools below in Alphabetical order to minimize suggestions of bias hopefully. But I tend to be pretty opinionated so take that for what it’s worth.

I’m sure everyone I’ve listed below will have issues with my descriptions to some degree and that’s ok. While I personally know many of people involved with these companies, I’m not an expert on their solutions. I highly recommend you talk to all of them and ask them your specific questions.

Note: I have not listed machine tool specific software like TigerStop‘s TigerTouch or Watt‘s new 3dPP Software. If you have tools like those, you likely already have those software options available to you and are familiar with them.

Other tools specific for Duct fabrication like Autodesk Fabrication CAMduct or Trimble ToolShop (Vulcan) are not covered because the Sheetmetal trades have been using them for years and are quite familiar with them.

The last thing to note is that just because a few solutions have an ‘X’ in the same column does NOT mean they even come close to addressing that category the same way or equally as well. Just that the tool helps with those major/broad categories I’ve listed. These tools do much more than I outline, I’m just covering some of my major observations. Review software demo’s and workflows closely.

| Tool | Content | Model Authoring | Spool Automation | Hanger Automation | Production Management | Machine Tool Integration |

|---|---|---|---|---|---|---|

| Allied BIM – Fabrication Center – Fabrication Desktop – Fabrication Tools | — — — | — — X | — — X | — — X | X — — | — X — |

| BIMrx (Microdesk) – BIMrx Core – BIMrx Fabrication – BIMrx Fabrication DBS – BIMrx MEP | — — X — | X X — X | — X — — | — X — — | — — — — | — — — — |

| BuildCentrix (Webduct) | — | X | — | — | X | X |

| ENGworks Global – Fab360 | X | — | — | — | — | — |

| eVolve – eVolve Electrical – eVolve Materials – eVolve Mechanical – eVolve Origin | — — — X | X — X — | X — X — | X — X — | — X — — | X — X — |

| GTP – FieldOrderZ – GTP Connect – Stratus – Syclone – Wireworks | — — — — — | X — — X X | — — X — — | — — — — — | X X X — — | — — X — — |

| HangerWorks Pro (Dewalt) | — | X | — | X | — | — |

| Manufacton (ViZZ Technologies) | — | — | — | — | X | — |

| MEP Track | — | — | — | — | X | X |

| MSuite – BIMPRO – FABPRO – FIELDPRO | — — — | X — — | X — — | X — — | — X X | — X X |

| PypeServer – PypeServer Connect – PypeServer Enterprise – PypeServer Lyte | — — — | — — — | — — — | — — — | — X — | X X X |

| SiteTrace (Acquired by BuildCentrix) | — | — | — | — | X | — |

| Trimble – BuildingData – Connect2Fab – EC-CAD – MEP Content – SysQue | X — — X — | — — X — X | — — ? — X | — — ? — X | — X — — — | — — — — X |

| Victaulic Tools | — | X | X | — | — | X |

| Virtual Building Supply (VBS) | X | — | — | — | — | — |

Allied BIM (https://www.alliedbim.com)

Allied BIM is a great group of guys. They’re a little smaller than some of their competitors but don’t let that fool you. They integrate with more variety of machine tools than their larger competitors. So what do they do?

- Fabrication Center – This is your production management system. Helps you keep track of what you’ve fabricated, what’s in process and what’s in the pipeline.

- Fabrication Desktop – This is a machine control application that integrates with their other tools. It’s a huge upgrade to what you’d get out of the box from TigerStop or Razor Gauge.

- Fabrication Tools – Help automate model and drawing production, spooling, etc. all in Revit. (you know, all those things Autodesk should have done but didn’t).

Allied BIM also sells machines last I knew. I’ve seen one of their setups and I tell you…if you want “White Glove” treatment and support….these are your guys. I don’t know anyone else installing a camera so they can remotely watch and assist your team on the shop floor. As they started out as a set of in house tools as a fabricator, they’re also the only company I know who’s run by guys who actually worked production. They’ve also recently partnered with ATG USA (Autodesk Reseller) to help support their sales efforts.

BIMrx (https://www.microdesk.com/)

While a well known Autodesk reseller, they’re the new kid on the block competing against eVolve MEP. It’s hard to describe but while they’re competing against eVolve Mechanical, they’re approach to tools they’re building seems quite different. I’m pretty impressed with what they’re doing and where they’re going. General feel is instead of big complicated commands that you use once in a while and do a lot, theirs are more a suite of simpler more elegant tools that you’re going to use again and again putting money back in your pocket.

Here’s a few offerings under the “BIMrx” branding…

- BIMrx Core – A lot of general Revit management tools.

- BIMrx Fabrication – Modeling automation and efficiency. Focus here is on Fabrication ITM workflows.

- BIMrx Fabrication DBS – Don’t have a Fabrication ITM database? Here’s one you can just buy vs build yourself.

- BIMrx MEP – Modeling automation and efficiency. Focus here is on RFA/Family workflows.

Microdesk has other offerings too but they’re not focused exclusively on MEP so I’m not going to cover them. I do however encourage you to take a look.

BuildCentrix (https://buildcentrix.com/)

Formerly known as WebDuct, they started out as a field ordering tool for Ductwork and other materials. Their Ductwork workflows have various integrations to CAMduct, ToolShop(Vulcan), PractiCAM, etc. But don’t let their Sheetmetal origins fool you. They’re a material logistics tool (pipe, consumables, tools, etc.) that integrates into a number of ERP systems used by MEP contractors like Viewpoint, Coins and others.

One of their more recent additions is an online duct builder which might be a good competitor to GTP’s FieldOrderZ. But because of their field logistics focus, they’re not really competing against Msuite, Stratus Connect2Fab or Allied BIM….yet. There are customers of those products that also using BuildCentrix.

ENGworks Global (https://engworksglobal.com/)

One of the new players in the Fabrication Content space is ENGworks Global. They build a lot of content directly for manufacturers. If you download content from a manufacturer, there’s a good chance it may be theirs. In early 2023, they’ve announced their product Fab360. This is their offering of a full blown database for Autodesk Fabrication. I’ve not personally reviewed their offering due to an NDA with another firm operating in this space (not on this list). None the less, don’t dismiss this casually. There’s a couple very well respected Fabrication experts associated with this company in recent years so I would expect this to be a quality offering.

eVolve (https://www.evolvemep.com/)

eVolve MEP is a company and suite of tools spun out of Applied Software. Applied Software ended up picking up Fabrication support after TSI’s demise when they acquired Enceptia (formerly DC CADD).

Their bread and butter (among other things) are tools to help model authoring, spooling, hanger placement, etc. Once again, this is a company that really shouldn’t exist except for Autodesk’s inability to listen to customers. They’ve built all the things you’d need and more to model with ITM content in Revit in contrast to Trimble’s RFA/Family based SysQue. On the ITM side, Microdesk is really the only major competitor with MSuite’s FabPro and Victaulic Tools taking a good sized bite of the apple too.

- eVolve Electrical – Electrical based model authoring and automation. Not sure but I think this is RFA based.

- eVolve Materials – This is a materials management and procurement system.

- eVolve Mechanical – ITM based model authoring and automation for duct, pipe and plumbing.

- eVolve Origin – This is eVolve’s custom prebuilt ITM Fabrication database.

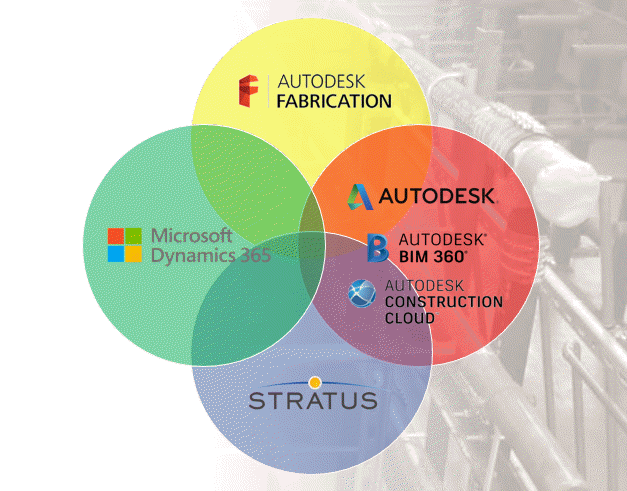

GTP (https://gogtp.com/)

GTP’s Stratus product is another one of the big competitors in the production managements space. Their differentiator IMO started as a focus on machine tool integration but as other’s have caught up, it’s become their ability to highly customize the system. This makes it a bit unwieldly to manage but if you master it, you can make it do a lot of things nobody ever envisioned and things their competitors can’t do. This flexibility also makes it a little easier to incrementally implement IMO as opposed to a larger more encompassing rollout common with other software implementations.

Here’s some of the products GTP offers…

- FieldOrderZ – This is a newer offering designed to facilitate ordering materials and even field based sketching of fabrication. It does intigrate w/Stratus but can also be used standalone.

- GTP Connect – This tool is designed to facilitate procurement from models.

- Stratus – This is GTP’s production management system. Works with CADmep or Revit as well as both RFA and ITM content. While GTP doesn’t have Spooling solution inside Revit, you can Spool completely within Stratus.

- Syclone – This is a tool used to import PCF file into Revit to generate a model. PCF is a format that can be exported from a number of applications to exchange piping component data.

- Wireworks – This is GTP’s model authoring tool but it’s specific to Electrical only. content in Stratus. There is no equivalent for mechanical that I’m aware of.

HangerWorks Pro (https://anchors.dewalt.com/anchors/)

HangerWorks Pro is a Revit Add-In to help with Hanger placement and modeling. It was originally written by GTP for Dewalt. It then disappeared for a while and it’s just recently resurfaced again but completely rewritten by the developers at MSuite from my understanding. I’ve not seen what the new rewrite looks like but do have a demo scheduled.

MEP Track (https://meptrack.com/)

MEP Track is another new production management system on the market. But it’s not like any other. Developed with a smaller contractor in mind, its production management without breaking the bank. It uses exports from CAMduct and ESTmep and leverages the data to enhance your production management capabilities. But don’t let their smaller budget conscious focus fool you. MEP Track integrates with CAMduct and your duct fabrication process way more than any of the other 1″big players” in this space.

Manufacton (https://www.vizztechnologies.com/)

Manufacton was really one of the first ‘Production Management’ solutions available in the industry. I’ve been told their original founder was from Autodesk and a lot of their funding came from some Autodesk insiders. However, unlike their 2 primary competitors at the time (MSuite and Stratus) they really seemed to struggle to gain market share in MEP. When I had my demo, they weren’t even able to tell me who any of their MEP customers were…I ended up telling them who they were.

Ultimately they looked for a buyer and were acquired by Vizz Technologies. I’m not familiar with Vizz Technologies or where they’ve taken the product since. However, it still appears to me to focus more as a high level, generic (not MEP focused) production management tool. Executive management may really like it but it doesn’t appear focused as much on the end users in Detailing or the Shop like you see with Allied BIM, MSuite, Stratus. Still, it’s worth a look of you’re looking for a solution to help manage your shop.

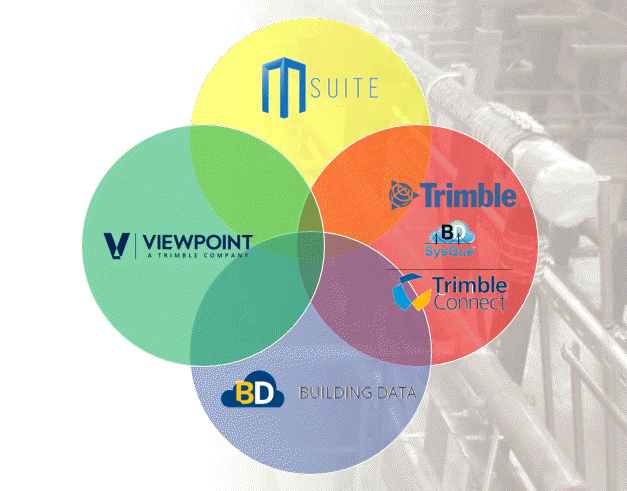

MSuite (https://www.msuite.com/)

MSuite is one of the big players when it comes to production management. If you’re looking for a solution and don’t look at them, you’re not doing your due diligence. They have a number of things they do but the big differentiator of MSuite in my opinion is their incredible focus on productivity. If managing the labor (productivity/scheduling) for your fabrication and install is your focus, there’s nobody that does it better IMO.

I hear a number of Union contractors dismiss Msuite claiming they’re not allowed to “track labor” but I find this a bullshit argument and excuse personally. There’s a number of union contractors using MSuite including some of my friends working at one of my competitors locally. I’m more than happy to put you in touch with a number of users if you think production tracking and scheduling is an issue.

Here’s a high level list of some of their tools…

- BIMPRO – This is MSuite’s set of tools for Model authoring. Spooling automation, Hanger Layout and more.

- FABPRO – This is MSuite’s production management system. Track everything your shop fabricates and have complete visibility to the labor effort it takes. Works with both RFA and ITM workflows.

- FIELDPRO – This is MSuite’s tool for tracking in the field. What’s been received…what’s been installed.

While MSuite has it’s roots in MEP, you’ll also see they’re making more headway in the industrial space than their competitors (IMO) near as I can tell. If you also do industrial work….take a serious look.

In a further boot to their credibility and playform, on May 13, 2022 MSuite announced they were acquired by Stanley Black and Decker. I’m expecting to see development excelerate even more with Stanley backing this suite of tools.

PypeServer (https://pypeserver.com/)

PypeServer is a little more difficult to explain. Most are familiar with it is from it’s early days as the programming and control system for Watts pipe profiling machines. But it’s changed in recent years and you’re likely not as familiar with who they are today.

Watts has since moved to using their own software 3dPP for their new machines. 3dPP looks to me like an almost identical clone (a very strong nod to PypeServer IMO). But PypeServer now supports a lot more machines…

- Pre-2020 Watts

- HGG

- Machitech

- Vernon

- TigerStop

- RazorGauge

At it’s core, PypeServer is most similar to a CAM program but yet it’s still quite different. So lets try to explain…

How PypeServer is different than other CAM programs from my perspective is their approach to a variety of things. For starters, most CAM programs output a CNC file for programming a part. PypeServer uses a database which can be used to recall production run parts or even queried to run reports on past production.

They also are starting to heavily leverage the cloud to facilitate data transfers eliminating the need to manage lots of files to program parts. One added benefit to this is it makes this a LOT easier to install a machine safely in your corporate network without having to add it to your domain and deal with antivirus or firewall issues that can affect machine performance. Instead, give it a connection to the web and that’s all your IT needs to do.

Another key distinction is that most CAM programs at best import exports from other CAD systems. PypeServer goes out of their way to integrate with others. Their list of importers is impressive. Each custom tailored to the CAD system they’re designed for. The Stratus import as an example, works automatically without the need for any operator actions. This minimizes the work within PypeServer to program the parts.

Another example of this is the ever growing list of Addin’s for other CAD systems to export more streamline the workflow. For our industry, their Add-ins for AutoCAD and Revit will push data to the cloud where it’s easily imported into their products without the need for file management. Here’s a rundown of their core products…

- PypeServer Connect – This is their Addin that exports parts from Revit, CADmep, Plant3d to PypeServer Lyte or PypeServer Enterprise.

- PypeServer Enterprise – This is their original program that’s used for Pipe Profilers.

- PypeServer Lyte – This is their newest addition used to drive linear cutting equipment like TigerStop and RazorGauge.

In the interest of disclosure, I am on PypeServer’s Board of Advisors. That means that for whatever reason, the listen to my ramblings about the industry. They’ve not in any way compensated me to write this and I’ve not submitted anything written here for their review. These are just my thoughts…consider them bias or not as you see fit.

SiteTrace.io (https://www.sitetrace.io/)

This company’s focus is field ordering of Duct and other accessories, hardware & material from the Field to Shop. Their application elminates the need for paper orders, spreadsheets, emails, faxes and phone calls for a more error free experiance eliminating the wasted time of traditional procurement methods.

SysQue (https://mep.trimble.com/)

I’ve been a big critic of Trimble for a long time. They’re history of buying multiple solutions, allowing them to get obsolete and then buying new ones always bothered me. However….I’m seeing signs of a new Trimble. A Trimble that’s interesting in bridging their solutions together and providing more open access via API’s an integrations.

So imagine my surprise to see their new Connect2Fab product in Tampa this January at the MEP Innovation conference. This looks like it’s going to go head to head against GTP’s Stratus, Msuite and Allied BIM.

So it’s new and that likely means it’s not as mature as some of their competitors. But it looks good and is impressive for just getting out of the gate. Considering all the other things Trimble offers in the market, this should be considered a real threat to competitors and a viable option for contractors.

Trimble’s other main tool is SysQue, their Model Authoring offering. Unlike eVolve Mechanical that’s focused in ITM/Fabrication Part workflow, SysQue is based on Revit’s RFA content. SysQue comes with it’s own content making it an attractive offering to many who don’t have the time, skills or money to invest in making their own.

Once again, this is a tool that shouldn’t need to exist except for Autodesk’s gross neglecte of the MEP contractor industry. But if you want to do fabrication modeling in Revit efficiently, you’ll need something so it’s worth a serious look.

Let’s face it…Trimble’s had everything they’ve needed and more to compete directly against Autodesk for some time. But their offerings didn’t integrate well and that wasn’t ever really a big strategy within Trimble. But that seems to be changing….from Detailing w/SysQue, Content (RFA & ITM), Submittal Management, Estimating, Collaboration and even ERP….imagine if (when) all that’s connected.

If Trimble manages to pull this off well and repair some of trust they’ve lost with some customers in the past, they’ll be well positioned to knock Autodesk flat on their ass IMO. Autodesk rarely shows up with a booth to any event with actual trades people in attendance. On the other hand you always see Trimble with a well staffed booth. I suspect you’ll see where this is going and how much traction it’s getting within 2-5 years.

- BuildingData – This is Trimble’s Fabrication ITM content library. Hands down, the largest collection of ITM on the planet.

- Connect2Fab – Trimble’s new Production Management solution for managing your shop from models.

- EC-CAD – This is Trimble’s AutoCAD MEP based modeling tool (Formerly East Coast CAD)

- MEPContent – This is Trimble’s AutoCAD Block, IFC and RFA content library.

- SysQue – Trimble’s Revit Addin for Model Authoring

Note: In the interest of disclosure, I’m not a user of SysQue and RFA content for MEP fabrication modeling. I use ITM content. That said, a lot of folks think I’m anti-SysQue. That’s not the case. I actually was involved in it’s early beta testing/development at a past employer. It’s a perfectly valid tool and is the right tool for many companies. The only thing I was ever against were some of the early marketing tactics like “Native Revit” and other bullshit sales tactics which for the most part have ceased now that Trimble acquired it.

Victaulic Tools (https://www.victaulicsoftware.com/)

Victaulic Tools is another interesting software offering. They’re not really a software company trying to capture the fabrication modeling market. Rather they built the tools in large part for their own BIM Services group and they sell them for a very modest cost to customers. Regardless of which tools people buy, they often also buy Victaulic tools due to it’s low cost and very helpful utilities.

Virtual Building Supply (https://itembuilders.com/)

Virtual Building Supply (VBS) provides ITM content for Autodesk Fabrication users. Whether you work in CADmep, ESTmep, CAMduct or Revit with Fabrication Parts, if you need ITM’s added to your database, VBS is a good source of high quality content. If they don’t have what you need, reach out and they’ll quote you to build it. Unlike many other content providers who provide “subscription” content services, VBS content is a “buy it once” model.

VBS also will provide a full database if you are in need as well. They’ll even manage your database. So if you need a full database or just a few ITMs, they’re well worth looking at.

Summary

So that’s my list of many of the major software tools available. There is no perfect solution. Many can be used alone or in conjunction with the others on the list. Some are even both competitors and partners with each other.

I really encourage everyone to look at all these tools if they address the issues they’re trying to solve. Just don’t get caught up on buzzwords. There’s a lot of users in the industry that will give you the pros and cons of each of these tools.